Dairy Derivatives Procurement, Emerging Technologies and Cost Structures 2030

Dairy Derivatives Category Overview

The dairy derivatives category is expected to grow at a CAGR of 4.5% from 2023 to 2030. The global need for dairy products is increasing due to a number of reasons, including the growing population and a better understanding of the health benefits of dairy products. There is a growing market for lactose-free and gluten-free items as the number of people who have these intolerances rises. the rising use of dairy derivatives in pharmaceutical applications due to their wide range of applications in goods like infant formula and dietary supplements. The category is being driven by the rising demand for these products and the shift in customer nutritional choices, as they are looking for more readily available and healthier food and beverage options. Dairy derivatives are used in cheese, yogurt, ice cream, and infant formula, among other foods and beverages. The growing demand for these products is driving the sector.

Order your copy of the Dairy Derivatives Procurement Intelligence Report, 2023 - 2030 , published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are continuously focusing on improving capacity and strengthening sustainable practices through partnerships and/or acquisitions. For instance,

- The H'lib Dzair Project helps Algerian rural development by enhancing small-scale farmers' livelihoods, strengthening regional dairy value chains, and minimizing the environmental impact of farms. As a result, Algeria's dairy industry is improved, and the country is less reliant on foreign milk.

- In April 2023, in an effort to reduce methane emissions from dairy cows, Lactanet Canada began the very first formal genetic assessment ever conducted. This was accomplished after many years of study and development, during which dairy cows in Canadian research herds underwent routine milk tests and had their methane emissions monitored.

- In May 2022, Arla officially completed a brand-new production facility at Pronsfeld Dairy in Germany. The project, which is Arla's largest dairy investment to date, will help the company to meet the world's growing need for healthful dairy products at competitive prices.

Dairy Derivatives Category Sourcing Intelligence Highlights

- The number of both big and small businesses operating in various regions has led to significant global fragmentation of the dairy derivatives category. Players engage in an intense rivalry with one another to expand their consumer base and provide superior customer service.

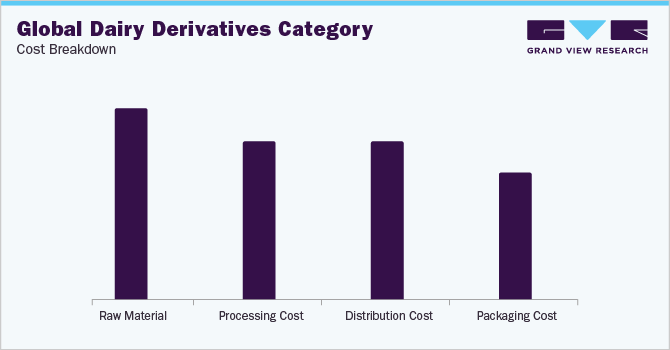

- Raw material accounts for the largest cost component of the dairy derivatives business. Other key costs include packaging cost and distribution cost

- Most of the companies offer products such as cheese, butter, yogurt, and ice creams.

Dairy Derivatives Procurement Intelligence Report Scope

The Dairy Derivatives category is expected to have pricing growth outlook of 3% - 5% increase (Annually) from 2023 to 2030, with below pricing models.

- Volume-based pricing model

- cost-plus pricing model

Supplier Selection Scope of Report

- Cost and pricing,

- past engagements,

- productivity,

- geographical presence

Supplier Selection Criteria of Report

- Sustainability,

- price,

- quality,

- reliability,

- flexibility,

- technical specifications,

- operational capabilities,

- regulatory standards and mandates,

- category innovations,

Dairy Derivatives Procurement Intelligence Report Coverage

Grand View Research will cover the following aspects in the report:

- Market Intelligence along with emerging technology and regulatory landscape

- Market estimates and forecasts from 2023 to 2030

- Growth opportunities, trends, and driver analysis

- Supply chain analysis, supplier analysis with supplier ranking and positioning matrix, supplier’s recent developments

- Porter’s 5 forces

- Pricing and cost analysis, price trends, commodity price forecasting, cost structures, pricing model analysis, supply and demand analysis

- Engagement and operating models, KPI, and SLA elements

- LCC/BCC analysis and negotiation strategies

- Peer benchmarking and product analysis

- Market report in PDF, Excel, and PPT and online dashboard versions

Dairy Derivatives Procurement Cost and Supplier Intelligence

A technique for separating and identifying the distinct components of a mixture is chromatography. Using this technique, various lipids, proteins, and carbohydrates in milk are distinguished from one another. The ultrafiltration procedure can separate various components in a liquid by allowing it to pass through a membrane. This technique concentrates milk's protein content and separates whey from milk. This category uses nanotechnology, which makes use of materials and methods that are at the nanoscale, to offer fresh and cutting-edge dairy products. Nanotechnology, for instance, can be used to create novel milk proteins that are simpler to digest or better ways to preserve dairy products. Microfiltration is a technique used to separate different components in a liquid by passing it through a membrane with small pores. It is used to remove bacteria and other microorganisms from milk.

List of Key Suppliers

- Nestle

- Danone

- Amul

- Fonterra

- Dean Foods

- Saputo

- Mengniu Dairy

- Yili Group

- Tyson Foods

- Arla Foods

Browse through Grand View Research’s collection of procurement intelligence studies:

- Office Supplies Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Office Furniture Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Comments

Post a Comment