Air Freight Services Procurement, Pricing Models and Revenue Forecasts 2030

Air Freight Services Category Overview

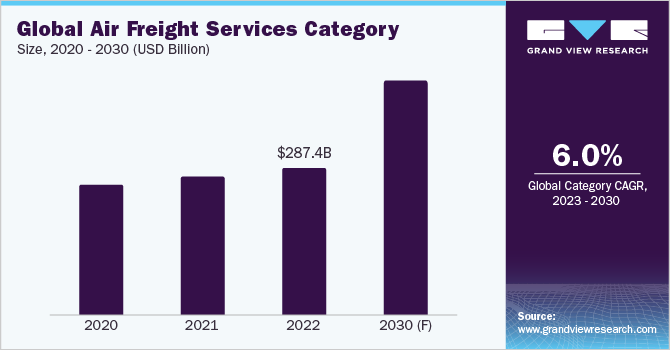

The air freight services category is expected to grow at a CAGR of 6% from 2023 to 2030. In 2022, the Asia Pacific region accounted for 32.4% of the total category share. Robust demand for goods industry-wide due to a rise in e-commerce is driving the demand for cargo services. However, in March 2023, according to IATA, the demand for global air cargo dropped by 7.7% year-on-year at a slower pace than in January and February 2023. Due to increasing belly freight capacity in passenger aircraft, the air cargo capacity increased by 9.9% year-on-year. Compared to March 2019, industry-wide CTKs (International) decreased by 8.1% in March 2023. Over 85% of the industry's total cargo demand is derived from International Cargo Tonnes-Kilometers (CTKs), which influence cargo traffic trends worldwide. The current volatility in this category is due to many operational and economic issues that have hampered international trade. Even yet, most carriers were able to outperform their YoY growth in terms of international cargo performance across all regions excluding LATAM and APAC in 2022.

Order your copy of the Air Freight Services Procurement Intelligence Report, 2023 - 2030 , published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Air Freight Services Sourcing Intelligence Highlights

- The global air freight services category is moderately consolidated with the top fifteen players accounting for 35% - 45% of the total market share. Leading players such as DHL, UPS, FedEx, Qatar, Delta, Kuehne and Nagel, DSV, DB Schenker, Bollore, and United Airlines command a major share of the market

- Leading companies such as DHL, FedEx, and UPS are increasing forward integration with regional players to expand their service offerings and concentrating on deploying various sustainable solutions to increase aircraft fuel efficiency

- Operating expenses such as fuel, direct maintenance, depreciation, and labor can account for between 40% - 50% of the total cost. Fuel and energy costs alone can account for between 12% - 18% of the total cost

- From a sourcing perspective, the companies mostly prefer approved provider models to reduce the risks and increase the potential for value creation

Air Freight Services Procurement Intelligence Report Scope

The Air Freight Services category is expected to have pricing growth outlook of 12% - 18% increase (Annually) from 2023 to 2030, with below pricing models.

- Dynamic pricing

- volume-based pricing

- cost-plus pricing model

Supplier Selection Scope of Report

- Cost and pricing

- Past engagements

- Productivity

- Geographical presence

Supplier Selection Criteria of Report

- By type of cargo,

- features (temperature sensitive, real-time shipment monitoring),

- operating capability,

- quality measures,

- technology,

- certifications,

- regulatory compliance,

- others

Air Freight Services Procurement Intelligence Report Coverage

Grand View Research will cover the following aspects in the report:

- Market Intelligence along with emerging technology and regulatory landscape

- Market estimates and forecasts from 2023 to 2030

- Growth opportunities, trends, and driver analysis

- Supply chain analysis, supplier analysis with supplier ranking and positioning matrix, supplier’s recent developments

- Porter’s 5 forces

- Pricing and cost analysis, price trends, commodity price forecasting, cost structures, pricing model analysis, supply and demand analysis

- Engagement and operating models, KPI, and SLA elements

- LCC/BCC analysis and negotiation strategies

- Peer benchmarking and product analysis

- Market report in PDF, Excel, and PPT and online dashboard versions

Air Freight Services Procurement Cost and Supplier Intelligence

Leaders in this sector including DHL Group, Qatar Airways, British Airways, and Delta Airlines aim to use at least 10% sustainable aviation fuels by 2030. For instance, in March 2023, BP, the parent company of Air BP, announced the sale of its ISCC EU sustainable aviation fuel to LATAM Group, one of Latin America’s biggest airlines. LATAM Cargo Chile operated the flight from Zaragoza, Spain, to North America. Similarly, in March 2022, BP and Neste announced a partnership with DHL Express to provide 800 million liters of Sustainable Aviation Fuel (SAF) until 2026. In 2022, DHL estimated that, assuming a 100% SAF usage, on approx., 800 million liters would mean 1,000 annual DHL flights between USA and Leipzig, Cincinnati, and Germany for 12 years, operated on Boeing 777s. With more such deals, DHL intends to use 30% SAF for all air transport by 2030. In an effort to curb carbon dioxide emissions, the CO2 savings would be two million tons through these collaborations. DHL states that it would be equivalent to 400,000 passenger cars’ annual greenhouse gas emissions.

List of Key Suppliers

- DHL Group

- UPS

- FedEx Corporation

- Kuehne and Nagel

- Qatar Airways

- United Airlines

- Delta Airlines

- Singapore Airlines

- CargoLux Airlines International S.A.

- American Airlines

- Etihad Airways

- Lufthansa

- All Nippon Airways

- Emirates

- Korean Air Lines Co. Ltd.

- DSV

- DB Schenker

Browse through Grand View Research’s collection of procurement intelligence studies:

- Office Supplies Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Office Furniture Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Comments

Post a Comment