Digital Payment Services Sourcing and Procurement Intelligence Report 2030

Digital Payment Services Cost and Pricing Analysis

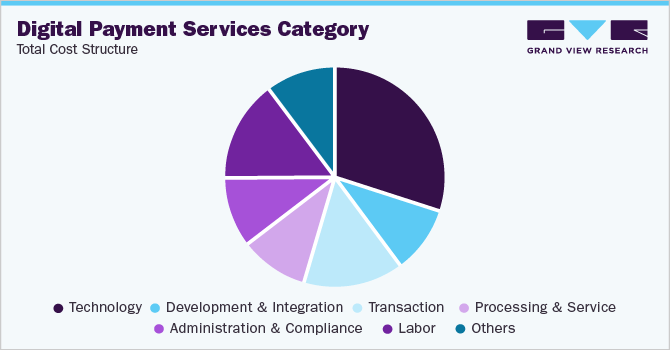

Unpacking the costs of digital payment services reveals a three-pronged approach: technology, transactions, and talent. The tech bill covers building and maintaining the infrastructure that keeps payments flowing, from servers and data centers to processing software. Transaction costs encompass the fees associated with each swipe or click, including credit card processing, network charges, and keeping fraudsters at bay. Finally, there's the human element – salaries and benefits for the customer service reps, developers, and security experts who keep the system running smoothly. While a typical service like PayPal might charge around USD 4 for a USD 100 transaction, and implementing blockchain could cost USD 1,500 monthly, these figures fluctuate depending on the specific transaction and provider you choose.

Order your copy of the Digital Payment Services category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Operational Capabilities - Digital Payment Services

Industries Served - 25%

Employee Strength - 25%

Years in Service - 20%

Key Clients - 10%

Geographical Presence - 10%

Revenue Generated - 10%

Functional Capabilities - Digital Payment Services

Application Program Interface - 20%

Payment Gateway - 20%

Payment Processing - 20%

Payment Security and Fraud Management - 20%

Transaction Risk Management - 15%

Others - 5%

Rate Benchmarking

In comparison with China, which has a single set of regulations for digital payments, the U.S. has a diverse regulatory landscape for digital payments that makes it expensive for enterprises to comply, resulting in higher costs for digital payment providers to comply with regulations. The cost of labor in the U.S. is higher, causing providers to pay more to their employees, increasing costs. The U.S. has a more complex regulatory environment for digital payment services, resulting in higher fees for providers. Additionally, the U.S. has a more developed infrastructure for digital payments, requiring providers to pay more for processing networks and data centers. The U.K. has stricter regulations for digital payment services, resulting in higher costs for providers. The U.K.'s developed infrastructure costs more for payment gateways and processing networks, while less competition in the market allows providers to charge higher prices without losing customers. This leads to higher costs for services in the U.K. compared to India.

List of Key Suppliers

- Visa

- Mastercard

- PayPal

- Alipay

- China UnionPay

- Amazon Pay

- Stripe

- PayU

- Paytm

- Adyen

Supplier Newsletter

- In November 2022, Mastercard partnered with Vesta to offer a fraud management platform to merchants in Latin America and the Caribbean. The partnership aimed to improve the consumer's digital experience and bolster trust in e-commerce by addressing the increasing need for online shopping and addressing evolving fraud threats in real-time.

- In May 2022, in order to transform its operations into digital payment solutions for small and medium-sized enterprises, Visa collaborated with working capital platform, Fundbox. The Pathward is a financial organization with federal registration that offers reliable banking infrastructure, issued Fundbox Flexible Visa Debit Card which is the initial step in the entire procedure.

- In March 2022, LexisNexis Risk Solutions acquired BehavioSec, a Swedish company specializing in behavioral biometrics tech, to enhance its device and digital identity-focused offerings. BehavioSec's predictive biometrics solution uses behavior analysis for continuous authentication, establishing identity trust, and preventing fraud. The acquisition became part of LexisNexis Risk Solutions' Business Services group.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Office Supplies Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Media Buying and Planning Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Digital Payment Services Procurement Intelligence Report Scope

- Digital Payment Services Category Growth Rate : CAGR of 20.8% from 2023 to 2030

- Pricing Growth Outlook : 8% - 10% (Annually)

- Pricing Models : Subscription fee pricing model and transaction fees pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria: Sustainability, price, quality, reliability, flexibility, technical specifications, operational capabilities, regulatory standards and mandates, category innovations, and others.

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Comments

Post a Comment