Facilities Management Services Procurement 2030 - Charting the Future

Facilities Management Services Category - Procurement Intelligence

Witness the meteoric rise of the global facilities management (FM) services arena, set to soar at a staggering 12% CAGR from 2023 to 2030. Embracing the dawn of innovation, hard facilities management specialists are transitioning from manual to cutting-edge solutions, particularly in areas like security and fire safety. The spotlight is on tackling surging energy costs, meeting imperative ESG targets, and embarking on decarbonization initiatives, fueling the fervor for energy management solutions which have become the talk of the town in 2023.

Look up for a workplace revolution as per Grant Thornton's 2022 findings! The dynamics of the workplace are metamorphosing, driving an uptick in demand for office makeovers. Fabric maintenance, fit-outs, and refurbishments witnessed a whopping 14 deals in 2022, a stark contrast to the meager four deals in 2021. Meanwhile, HVAC facilities management notched up 12 deals in 2022, doubling the count from the preceding year.

Order your copy of the Facilities Management Services category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Delve deeper into the landscape of FM M&A ventures and witness the changing tides! Trade buyers took the helm, steering 55% of deals in 2022, marking a 6% ascent from 2021. This strategic shift hints at private equity players treading cautiously amidst escalating debt costs. Trade buyers, cognizant of the potential for consolidation, are eyeing economies of scale while guarding their margins.

Venture into the British FM arena and be enthralled by the unfolding saga! Grant Thornton's FM 2023 revelation unveils a record-breaking 87 transaction deals in H1 2023, continuing the upward trajectory since 2019. Private equity flexes its financial muscles, funding nearly half of the FM deals in the region. Hard FM steals the spotlight yet again, dominating the landscape. Meanwhile, soft facilities management, particularly in the realm of cleaning services, is witnessing an unprecedented surge. With hygiene thrust into the limelight post-pandemic, soft FM deals in cleaning services soared to 23% in H1 2023, up from a modest 15% in H1 2022. Brace yourselves for a paradigm shift in the FM landscape!

Behold the illustrious highlights from the FM sector's dealmaking arena:

- In July 2023, Cap10 Partners LLP announced the acquisition of Sureserve Group plc. The deal was valued at USD 260 million. The latter specializes in providing compliance and energy services. Through Cap10’s support, Sureserve aims to achieve the UK’s Net Zero targets of many public sector bodies and social housing.

- In May 2023, Freshstream Investment Partners Limited announced the acquisition of MCR Group. The latter is an Irish provider of outsourced solutions such as security, personnel, engineering, and cleaning services. The deal aims to expand MCR’s operations further across Ireland.

- In March 2023, Carbon Architecture was acquired by Bellrock Property & Facilities Management. This was Bellrock’s first venture in the decarbonization sector. The deal would enable Carbon Architecture to form a new division while expanding its analytics and software solutions to Bellrock’s 900+ clients. The solutions will help customers achieve their net-zero targets.

- In March 2023, HIG Capital through its affiliates purchased Synecore and Meesons Future Limited. The Andwis Group will be formed by Meesons, Synecore, Classic Lifts and CPS. The last two are H.I.G.'s portfolio companies. With the help of this deal, they aim to form a combined integrated technical services provider serving all HVAC sub-segments across commercial, leisure, retail, and hospitality industries.

Facilities Management Services Sourcing Intelligence Highlights

- The global facilities management services industry is highly fragmented. Compared to hard FM services, the soft FM services market is more consolidated. However, the number of transaction deals occurring in the hard facilities management services sector has been on the rise following the pandemic.

- The four major cost inputs in this category are labor, materials and supplies, energy, and taxes and government policies.

- The bargaining power of the global suppliers is moderate due to increased fragmentation. However, compared to general service providers, integrated facilities management suppliers command a higher bargaining power owing to the provision of specialized services and a higher global reach.

- In this category, Germany is the most mature and the largest market in Europe.Innovations like personalized workspace concepts and active space management are what distinguish these markets in particular. Higher ESG standards and increased operation and maintenance costs force companies to make larger investments in their structures.

List of Key Suppliers

- Jones Lang LaSalle IP Inc. (JLL)

- Sodexo

- CBRE Group, Inc.

- Compass Group plc

- Cushman & Wakefield Global, Inc.

- MAB Facilities Management

- Aramark Corporation

- EMCOR Facilities Services, Inc.

- OCS Group

- Serco Group plc

- Veolia Environment S.A.

- Tenon Group

- ISS A/S

Browse through Grand View Research’s collection of procurement intelligence studies:

- Call Center Service Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Commercial Real Estate Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Facilities Management Services Procurement Intelligence Report Scope

- Facilities Management Services Category Growth Rate : CAGR of 12% from 2023 to 2030

- Pricing Growth Outlook : 10% - 18% (Annually)

- Pricing Models : Cost Plus, contract-based, fixed and variable service-based pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Type of FM service (cleaning, HVAC, food, laundry, building, etc.), technological software, operational capabilities, quality measures, certifications, data privacy regulations, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

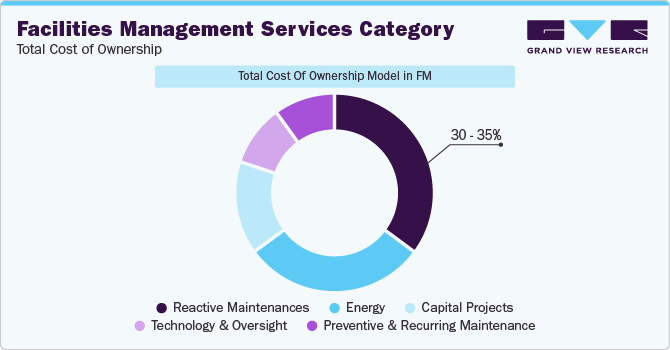

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Comments

Post a Comment