Translation Services Procurement 2030 - Strategies for Revenue Growth and Consumer Engagement

The translation services category is expected to grow at a CAGR of 4% from 2023 to 2030. The need for these services is only growing due to increased globalization and interconnectedness. There is a greater demand than ever for precise and trustworthy interpretations for business, vacation, or personal communications. Growth in the e-learning segment is further aiding category expansion as people are constantly trying to develop new skills. The category can be classified into two heads - machine translation (MT) and human-assisted translations. Machine translation has become increasingly prevalent with the development of artificial intelligence (AI), natural language processing (NLP), and computer power. There are five main types of machine translation, namely, Hybrid Machine Translation (HMT), Rule-based Machine Translation (RBMT), Statistical Machine Translation (SMT), Example-Based Machine Translation (EBMT), and Neural Machine Translation (NMT). Out of these, SMT dominated the MT services segment, accounting for between 65% - 73% of the total share in 2022.

The global translation services category was estimated at USD 40.5 billion in 2022. Leading companies such as Google, Amazon, and Microsoft continue using advanced analytics, and ML algorithms to enhance their MT platform capabilities. There is an increasing preference for hybrid MT-QE systems. The use cases of the quality estimation (QE) algorithm will increase significantly to train NMT engines for complex fields such as law and pharmaceuticals. A survey conducted in 2020 found that following the pandemic, the demand for medical translation services increased by almost 49%. The telehealth and medical interpretation sectors saw robust and steady demand in 2022 as accurate patient translations enabled medical professionals to obtain accurate information.

Order your copy of the Translation Services Procurement Intelligence Report, 2023 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

According to translators, in 2023, utilizing translation software helped in increasing their productivity by at least 30% - 40%. MT helps companies reduce their translation costs by 80% - 90% that arise from irrelevant email communication, human mistakes, and time spent on updating and searching databases. To maximize global sales potential, companies are considering translating their websites into the languages of the top four economies, namely, the U.S., China, Japan, and Germany. By doing so, companies can potentially access up to 50% - 80% of worldwide sales. Local or native language interpretations thus play a very important role, from a brand connection perspective. According to Webinar Care, in 2023, 86% of localized or regional mobile advertisements performed better than their English counterparts. Click-through rates and conversion rates also increased by 42% and 22% respectively.

The global translation services category is highly fragmented. The supplier landscape consists of different types of players such as website, interpretation, machine, and/or audio/video translation. The translators operate in three markets-regional, local, and global. According to industry experts, with the presence of so many varied players, there will be a lack of consolidation, especially in the language and translation industry as the category is ever-growing and very large. The sector would continue to rely heavily on human translators despite quickly evolving and improved technology, which would make economies of scale-and hence consolidation-more difficult. All such factors reduce the bargaining power of the suppliers.

Translation Services Sourcing Intelligence Highlights

- The translation services category is highly fragmented. A mix of website, interpretation, machine, and/or audio/video translation service providers make consolidation a challenge in this industry. As a result, the bargaining power of suppliers is reduced.

- Some of the highest-paying translation languages in 2022 were German, French, Arabic, Dutch, and Chinese.

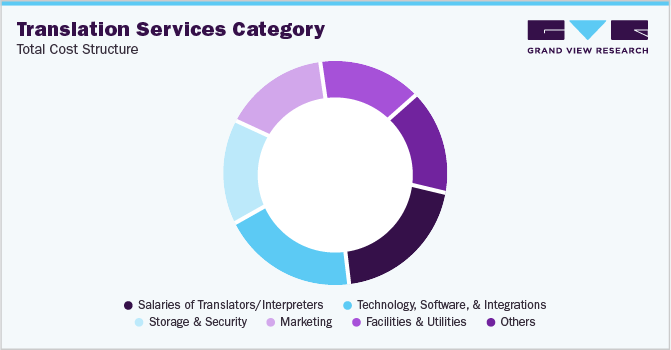

- The largest cost components are the salaries of different translators or interpreters in combination with the technology and software required.

- Under translation services sourcing, Singapore, Netherlands, Denmark, Sweden, the U.S., the UK, China, and India are the most preferred countries.

List of Key Suppliers

- TransPerfect Global, Inc.

- Lionbridge Technologies, Inc.

- LanguageLine Solutions (Teleperformance SE)

- Semantix

- Welocalize, Inc.

- Lingotek, Inc.

- Yamagata Corporation

- RWS Group

- Argos Translations Sp. z o.o.

- Keywords Studios Plc

Browse through Grand View Research’s collection of procurement intelligence studies:

- Digital Procurement Systems Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Helium Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Translation Services Procurement Intelligence Report Scope

- Translation Services Category Growth Rate : CAGR of 4% from 2023 to 2030

- Pricing Growth Outlook : 10% - 15% (Annually)

- Pricing Models : Volume (words)-based, hourly rate, cost plus, and competitive pricing model Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Localization and types of translation services, AI or proprietary platforms, marketing or legal translation, e-learning translation, software localization services, DTP and other services, operational capabilities, quality measures, certifications, data privacy regulations, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Comments

Post a Comment