Lab Chemicals Sourcing and Procurement Intelligence Report 2030

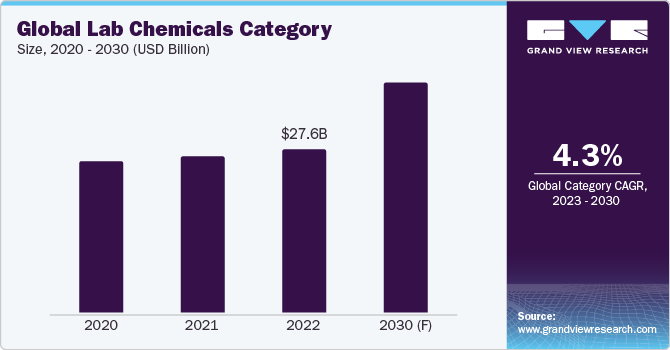

The lab chemicals category is expected to grow at a CAGR of 4.3% from 2023 to 2030. Factors such as the utilization of laboratory chemicals in academic institutions, pharmaceutical research and development (R&D), and healthcare organizations are driving the category’s growth. Additionally, growing awareness about healthcare and environmental concerns, and technological advancements in the industry are also expected to boost the category over the forecast period.

The category has witnessed advancements in compound manufacturing, such as additive technologies, automation, and digitalization. The rising implementation of the Internet of Things (IoT) to capture operational data and streamline the process can help in evaluating material quality. The acquired data through IoT can simulate and predict maintenance requirements to enhance asset life. For instance, through sensor measurements, operators can prevent production losses and unexpected shutdowns due to overheating.

Order your copy of the Lab Chemicals category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

a

a

The global lab chemicals category size was estimated at USD 27.6 billion in 2022. AI and machine learning (ML) algorithms can enhance laboratory experiments and clinical trials by generating new biochemical formulation and material combinations. AI can also automate chemical processes by collecting valuable data to advance operational efficiency. Leakages or contamination can be prevented at an early stage using AI solutions.

The rising focus on reducing the impact of hazardous compounds and materials on the environment has resulted in the emergence of green chemistry. This pushes manufacturers to move towards alternative energy resources, enhance waste management, and install recycling technologies to prioritize environmental regulations and sustainability. Rising demand for personalized medicines and advanced diagnostics is driving the growth of specialized compounds. Personalized medicines offer unique and tailored solutions to a specific diseas

Lab Chemicals Sourcing Intelligence Highlights

- Lab chemicals production often requires specific raw materials, which can vary as per vendor. As a result, suppliers can have moderate bargaining power. However, there are usually multiple suppliers for basic chemicals, which reduces the dependency on a single source. As a result, the bargaining power of these basic chemical suppliers is low due to presence of many players.

- The category is highly competitive, with many established players and constant research and development activities. Companies compete based on product quality, price, innovation, and customer service. Differentiated products and specialized chemicals can create brand loyalty, but overall, the competition is intense.

- Raw materials, staff salaries, laboratory supplies, equipment and tools, and energy costs are some of the cost components in the category. Other cost considerations include repairs and maintenance, legal costs, insurance, and packaging and transportation.

- To start a business in this category, a company needs to follow regulations specified by various governing bodies. For instance, according to Occupational Safety and Health Administration (OSHA) health standards 1910.1450(a)(2), is required that specifies the limit of employee exposure to hazardous chemicals.

List of Key Suppliers

- Thermo Fisher Scientific

- Avantor

- Merck Group

- Thomas Scientific

- Agilent Technologies

- Perkin Elmer

- TCI America

- BD Biosciences

- AquaPhoenix Scientific

- GE Healthcare

- Bio-Rad Laboratories

Browse through Grand View Research’s collection of procurement intelligence studies:

- Corn Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Commercial Real Estate Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Lab Chemicals Procurement Intelligence Report Scope

- Lab Chemicals Category Growth Rate : CAGR of 4.3% from 2023 to 2030

- Pricing Growth Outlook : 5% - 6% increase (Annually)

- Pricing Models : Volume-based pricing, cost plus pricing, value-based pricing, competition-based pricing

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Product range, purity, and grade, end-to-end services, global reach, regulatory compliance, operational capabilities, quality measures, certifications, data privacy regulations, and others.

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Comments

Post a Comment