Industrial Gases Sourcing and Procurement Intelligence Report 2030

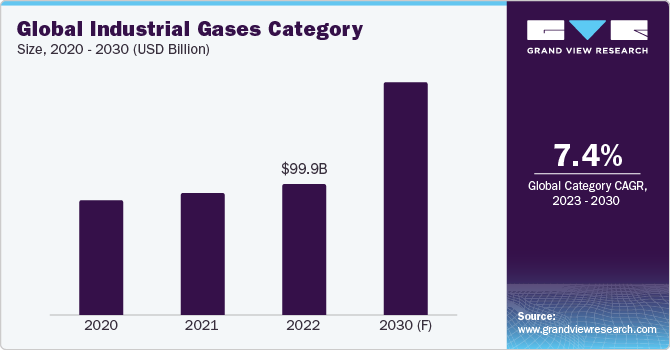

The global industrial gases category is anticipated to grow at a CAGR of 7.42% from 2023 to 2030. The growth is driven by rapid industrialization, rising manufacturing sector (wherein industrial gas is commonly used in metal fabrication and welding) in developing economies, and utilization of industry products in several sectors such as healthcare, food & beverage, metals, mining, and manufacturing. Products offered in the industry are also utilized in the photovoltaic sector for the production of flat panels, solar displays, semiconductors, and other products. Growing acceptance and popularity of electronic gadgets across the globe is fueling the demand in this category.

Various nations are witnessing an increase in the usage of green industrial gases due to rising environmental awareness and the ensuing need for clean energy. Typically, nitrogen, carbon dioxide, hydrogen, and oxygen are the most frequently used gases in various sectors, which are delivered in both gaseous as well as liquid form for the end-usage, through the tankers. Filtration of the air cryogenically through air separation units is a typical method utilized to produce these gases. In addition, they are also referred to as specialty gases, refrigerant gases, medical gases, and fuel gases, depending on their use in various industries. Furthermore, applications of industrial gases in the mining and metals sector are also fueling the global demand.

Order your copy of the Industrial Gases category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

In 2022, oxygen led the industry and generated the largest revenue share in terms of product. Oxygen finds use in copper smelting, steel melting, medical, and other industrial processes. It is well known that oxygen increases fuel's thermal efficiency. Therefore, using oxygen as an approach can help improve the energy yield from fuel. In a similar vein, it can also be applied to coal gasification systems, contaminated water treatment, and hazardous waste remediation. In the pulp and paper sector, it is thought to be a substitute for chlorine in terms of reducing pollution. Nitrogen witnesses the fastest growth rate and penetration and holds the second spot in terms of market share. It is used extensively in the pharmaceutical and medical sectors.

The global industrial gases category was valued at USD 99.9 billion in 2022. Over the course of the projected timeframe, the category will be shaped by the sharp increases in urbanization and industrialization rates that have been recorded in both developed and emerging nations. The category is expected to benefit from the rapid expansion of new facilities put up by the urbanization process, particularly in the manufacturing and processing industries. As per a report, many of the world's most populous nations such as Vietnam (over 36.9%), China (over 59.9%), India (over 33.9%), and Italy (over 70.9%) have their people living in urban areas. Therefore, the need for products offered in the category will also increase as the application sector grows.

Industrial Gases Intelligence Highlights

- The global industrial gases category is consolidated with the presence of a small number of significant firms that control most of the market share and have multiple channels for the production and distribution of their finished products across the world.

- China is the preferred low-cost/best-cost country for sourcing industrial gases due to rising gas supplies, low-cost clean energy, sustainable gas pipeline connection fees, and strong pass-through mechanisms.

- The bargaining power of suppliers is moderate. Manufacturers only work with a select group of long-term suppliers to preserve productivity and low operating costs.

- Feedstock (natural gas), energy, labor, logistics, storage, equipment, depreciation, and taxes & profits are the major cost components of industrial gases.

List of Key Suppliers

- Air Products and Chemicals, Inc.

- BOC Limited

- Coregas Pty Ltd

- Iwatani Corporation

- L’Air Liquide S.A.

- Linde plc

- Matheson Tri-Gas, Inc.

- Messer SE & Co. KGaA

- Strandmøllen A/S

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases, Inc.

- Yingde Gases Group Company Limited

Browse through Grand View Research’s collection of procurement intelligence studies:

- Corn Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Commercial Real Estate Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Industrial Gases Procurement Intelligence Report Scope

- Industrial Gases Category Growth Rate : CAGR of 7.42% from 2023 to 2030

- Pricing Growth Outlook : 5% - 10% increase (Annually)

- Pricing Models : Cost-plus pricing, fixed pricing

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Industries served, revenue, employee strength, certifications, production capacity, types of gases (carbon dioxide, nitrogen, hydrogen, oxygen, etc.), and others.

- Report Coverage : Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Comments

Post a Comment