HDPE Procurement, Price Trends, Forecast and Analysis Report 2030

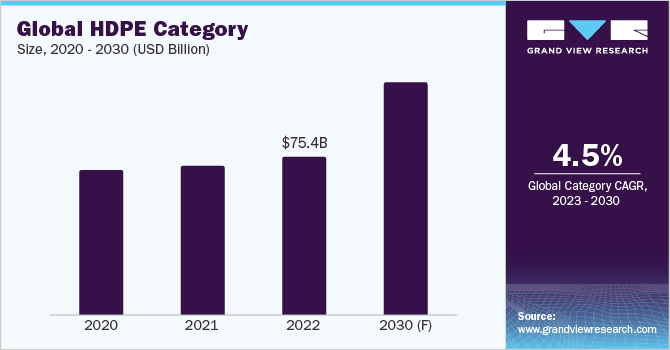

The HDPE (High Density Polyethylene) category is expected to grow at a CAGR of 4.45% from 2023 to 2030. Factors such as high ductility, excellent chemical resistance, increased impact strength, and reduced weight allow HDPE to be used in varied industries. Wide applications of this product in automotive, packaging, healthcare & pharmaceuticals, infrastructure & construction, electrical & electronics, and agricultural industries are fueling the category growth. It is majorly being used in the form of products such as detergent bottles, food wraps, shopping bags, and automobile fuel tanks, globally. The packaging industry holds the largest segment in the category accounting for 45%-50% of the total share. Research & development and technological innovation in High Density Polyethylene bag design and manufacturing are further driving the category growth.

The global HDPE category size was valued at USD 75.43 billion in 2022. One of the key trends is the increasing R&D and technological innovation in the category of developing eco-friendly and more sustainable products. Advanced closure systems and tamper-evident features are increasingly becoming popular which portrays the feature of providing visible indications of unauthorized access or tampering to the bag’s content. Tear strips, tamper-evident seals, and specialized closure mechanisms ensure consumers the safety and integrity of products stored inside.

Continual research in this field has added chemicals that increase HDPE bags' capacity to decompose to make them more environmentally friendly.

Order your copy of the HDPE category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

The largest segment in the packaging industry uses this product for film production. Health and safety concerns post-COVID-19 have increased the demand for packaged food items to maintain hygiene. To develop an eco-friendly solution for packaging, a blend of cassava starch and HDPE is used with green tea by melt extrusion, aiming for a greener food packaging solution.

Innovation and technology have rapidly advanced the recycling sector in this category. In 2023, Calgary-based company Nova Chemicals Corp. is pushing sustainability by starting a new project and constructing its first mechanical recycling facility in Indiana, U.S. This facility's function is to transform used plastic sheets into Nova's Syndigo recycled polyethylene, which is used commercially. Players are also collaborating with firms to develop sustainable plastics for the packaging industry. The solutions have helped in enhancing the quality of recycled HDPE. For instance, in 2022, Baerlocher, a plastic additives supplier collaborated with machinery OEMs and polyethylene supplier ExxonMobil to innovate and develop new sustainable plastic for the packaging industry. Innovative Baeropol T-Blends from Baerlocher significantly enhance the quality of recycled HDPE.

Production planning and innovation in manufacturing processes have allowed players to enter large-scale production of HDPE products. For instance, Formosa Plastics Corporation invested USD 207 million in 2022 towards a new production facility in Texas, U.S. The project is predicted to be finished by October 2025. Alpha olefins, which are required to generate HDPE and other products, can be produced at the plant at 100,000 tonnes per year capacity after the setup.

HDPE Sourcing Intelligence Highlights

- The global HDPE category is fragmented, with numerous small and large players operating in different regions. The competition between players is intense as they strive to gain a wider customer base and improve customer experiences.

- The suppliers of the raw materials in this category have high bargaining power since raw materials constitute about 60%-70% of the product. There is a significant impact on the prices of the category if the supplier raises the prices.

- Raw materials, assets, and utilities costs form the most significant cost component in the category. The overall cost also depends on the type of machine used such as extrusion blow, injection blow, and injection stretch blow for production.

- Most service providers offer complete services from designing, manufacturing, quality check and licensing, and shipping of the product.

List of Key Suppliers

- Borealis AG

- Lotte Chemical Corporation

- The Dow Chemical Company

- PetroChina Company Limited

- Abu Dhabi Polymers Company Limited

- Formosa Plastics Corporation

- Exxon Mobil Corporation

- LyondellBasell Industries N.V.

- SCG Chemicals Public Company Limited

- INEOS AG

Browse through Grand View Research’s collection of procurement intelligence studies:

- Corn Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Commercial Real Estate Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

HDPE Procurement Intelligence Report Scope

- HDPE Category Growth Rate : CAGR of 4.45% from 2023 to 2030

- Pricing Growth Outlook : 2% - 4% (Monthly)

- Pricing Models : Cost plus pricing model, volume-based pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : By type, packaging options, operating capability, durability, quality measures, technology, certifications, regulatory compliance, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

Comments

Post a Comment